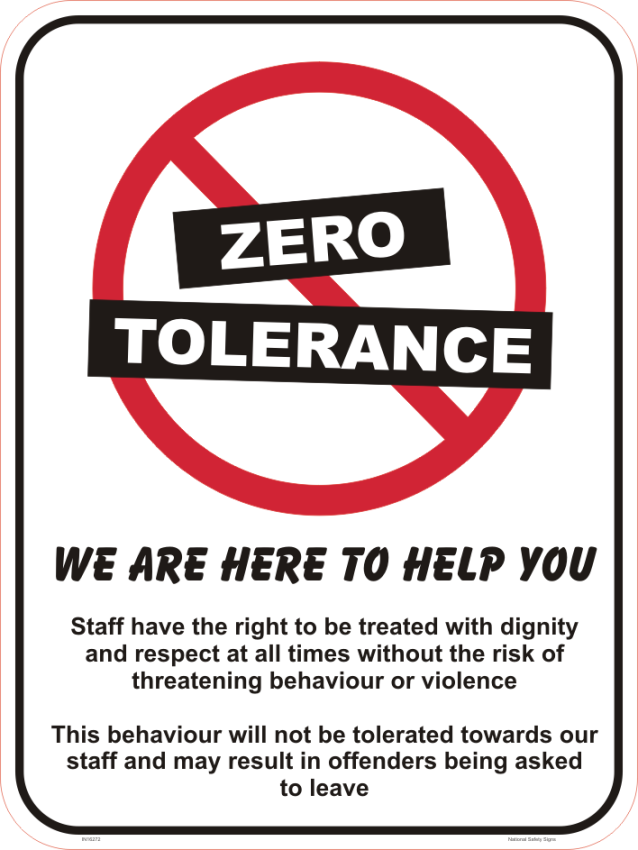

Over the past half decade or so, you must have noticed the proliferation of “zero-tolerance” signs at businesses and government services. They quite rightly point out that abusive language; threats of violence; and actual violence will not be tolerated and will result in a cessation of services.

But why the recent proliferation? Are Australians becoming more abusive and aggressive? Are governments and corporations just becoming more protective and concerned about their staff?

I think not. I think there are other causes. In the case of government services, it is severe staff cut-backs resulting staff not being able deal with people as quickly and as caringly as in the past. In the case of corporations, it is corporations trying to do consumers over and relying on their staff in call centres and over the counter to deliver their uncaring intransigence to those consumers.

We might rightly say that consumer abusiveness is unacceptable, but that does not mean we should not inquire as to why that abusiveness is increasing.

A couple of weeks ago I wrote about a few personal examples of businesses behaving badly. Everyone I talk to has examples.

I have had a lot more since. Qantas. I booked a ticket for a Christmas trip. There was an accidental mismatch of dates so I had to change the return date. Fee: $203. OK, you can cop a fee for changing a flight. But when you go on line to change the return flight, it will not let you do so unless you “change” the outgoing flights as well – to exactly the same flights as you originally booked and pay another $203 fee for “changing” flights you did not want to change.

It is a minor infuriating example. But it is happening all the time everywhere by nearly every big corporation – a little gouge here, a bigger gouge there, a rip-off here. Just a sequence of immoral, unethical, cunning ways to unjustly extract money from consumers.

Suncorp. Suncorp offers compulsory third-party insurance in Queensland and wanted to increase their share as against the non-profit RACQ and others. So, they offered a little bit of coverage for the at-fault driver. A lot of people moved to Suncorp.

Then a few years later came the classic corporate letter beginning with the anodyne “We are changing our . . . . “. Whenever you get such a letter, you know that what follows in fine type and confusing language will be a corporation taking something away from the consumer.

Suncorp was taking away the coverage for the at-fault driver in the full knowledge that the vast majority of people will just renew without asking questions after they have grabbed some market share.

Home insurance. Our house and contents insurance renewal went to an eye-watering $8500. I shopped around and got it down to $5400. Well done, AAMI. So, I signed up and found in the fine print that you could reduce your premium by increasing the excess.

So, I rang AAMI to find out. By increasing the excess from $1000 to $5000 the premium dropped by $1700. Sure, there is a good case for insurance companies to get rid of lawn-mower-broken-window claims that are expensive to process. But to play on people’s fears of having a $5000 liability and, in effect, charge them a $1700 premium to cover a $4000 loss is inexcusable.

Banks. Taken across the multi-billion-dollar mortgage industry a mean and sneaky trick adds an astonishing deceit of $1.4 billion a year. Unfortunately, it takes a bit of mathematics to explain so it will be a complete turn-off to consumers, and the banks will continue to get away with it.

It starts with the formula for compound interest which should be applied to every mortgage and mortgage off-set account. But the banks do not apply it. They apply a raw daily rate. They divide the annual rate by 365. But they charge monthly and apply that daily rate throughout the month. It means mortgagors are paying interest upon interest through the month. The upshot is that nearly all mortgage-holders in Australia pay a higher annual interest rate than what is advertised.

On the average 5.95% loan, the actual interest is about 6.1%.

I stumbled upon this because of some family arrangements that require me to calculate interest at the bank rate. The bank’s interest never matched my strict compound-interest formula.

I have always been fairly confident that this corporate rip-off has been going on for a long time, but not confident enough to go public until I did a bit of internet searching and found that research (https://theconversation.com/why-youre-probably-paying-more-interest-on-your-mortgage-than-you-think-213862 ) by a couple of UNSW accounting lecturers accorded with my observations.

Yes it is all legal in multiple pages of tiny type that no-one reads before clicking “I accept”, but utterly unethical.

Apple. My Apple ID (my ordinary email) and the two-factor authentication have been hacked and the hacker bought $1500 worth of gambling chips, since reversed by the credit card. I could not reset the password because it required a code on the two-factor authentication (my mobile number) and it prompted for a number ending in 29 whereas mine ends in 31.

I rang Apple and got no satisfaction. Then the emails came in saying my (hacked) ID had changed its payment method to some other poor sod’s stolen credit card. I estimated that the hacker had got more than $30,000 by now. I rang Apple to warn them (more la-la line waiting). Apple just nullified my email address as an Apple ID and every app, music, and everything else was irretrievably lost.

Apple said I had to start again. In effect buy all my apps again and in effect get a new phone and buy software to get the data from the old phone and transfer it to the new because Apple has engineered it so that cannot be done.

Apple did not care less. Others are in the same shoes. Apple engineers are looking at it, I was told. I was left in blind fury, but scrupulously polite and calm to the call-centre people upon whom Apple had inflicted the task of defending the indefensible.

Yes, I accept that all this sounds like an out-of-character, personal, anecdotal rant. But I have no doubt that my personal gripes are representative of a big cultural change in Australia: virtually every corporation is out to use whatever subterfuge, website bamboozlement, and tricky marketing tactic to skin every consumer for whatever they can get, and they train their innocent staff to be complicit in the greedy enterprise.

And the far-right billionaires who profit from it whip up diversionary scare tactics to shift the blame from where it really belongs.

Of course, people get angry. Understandably they want to vent their anger. Alas, their anger is vented on the people before them: staff at desks and in call centres. The real blame lies elsewhere: in corporate policies of greed and government cutbacks generated by right-wing, big-business propaganda that says we cannot afford not to have cutbacks.

So, when you see the “zero-tolerance” sign, do not ask why people are so aggro these days; ask WHY are they so aggro and what root causes can be changed to make them less so.

Crispin Hull

This article first appeared in The Canberra Times and other Australian media on 8 November 2023.

I agree, businesses are using notices applicable to other situations e.g. emergency departments in hospitals as a way to refuse to deal with genuine customer complaints. I have been on both sides of the counter as it were and yes, there are unreasonable customers, but it is my observation that in the last 30 years front line staff in business and in the public service, in person or in call centres, are useless for anything except the most basic questions (and sometimes not even then). Outright rudeness is not common but obstructionism is universal (I presume on the instruction of management). Big business, and these days they are almost all one deals with, adopt the policy of making things so difficult the customer gives up (which is by far and away the more common response than being “abusive”). It makes business sense: no individual customer is significant to the bottom line. For the same reason asking to speak with the manager, or even someone who knows anything about the subject, will get you nowhere. If one has the patience, government or industry complaints bodies will sometimes resolve an issue.

I found Air Canada to be worse than expected. Two last minute cancellations, with the next flight overbooked and a 10 hour delayed bag. Paid $ 342 to get an earlier flight, which they cancelled. Numerous phone calls and numerous sorties on their websites and still have not recovered the $342. Nie wieder!

Spot on again, Crispin. This is, simply, what it has become, and how it happened. Pointing it out is a considerable service to the community.

thanks Mr Hull, for exposing these ripoffs by the hard line greedy corporates , Agree the anger is likely caused by these actions tho most dont realise it, Cheers to you

A recent price hike I recently noticed in the supermarket was my Uncle Toby’s Plus Iron breakfast cereal, retailing at $8.80 had a quantity reduction from 710 grams to 630 grams. That’s effectively an 11.27% inflation price increase. The brand has many other variants of breakfast cereal, all of which have had a quantity reduction.

The packet has a consumer services phone number on it, so I phoned it. I asked the guy which constituents of the product had increased in cost, to which the consumer service person answered that he couldn’t tell me that. So I asked to be bumped up to management, to which he had to decline my request. So now I have to assume that they don’t provide a consumer service, instead it is a marketing service.