It is an uncoordinated, off-the-rails, unfair, loophole-ridden schemozzle. It is Australia’s tax system, of course.

The Real Estate Institute has just launched yet another campaign against stamp duty. The Queensland Government has just enacted a crafty new land tax which other states will follow. A High Court challenge against electric-vehicle taxing looms. Federal Labor is sticking doggedly to the Coalition’s Stage Three tax cuts which will pour billions into the wallets of rich, middle-aged men. And is sticking with other policies which do the same thing: negative gearing, cash rebates for franked share dividends, capital-gains tax concessions and superannuation tax immunity.

In the meantime, one of the worst taxes imaginable – payroll tax – continues its corrosive effect on employment. The second worst – stamp duty – cruels first home buyers and people seeking to move to housing better suited to their needs. And income tax remains a tax for suckers who don’t have lawyers and accountants to dodge it.

If ever there was a time not just for a wholesale review of federal and state taxes but to ensure the review is acted upon, this is it. Because Budgets are in massive deficits in every jurisdiction.

I will turn first to Queenland’s new land-tax arrangements which display astonishing yet simple lateral thinking simple and will enable the Queensland Treasury to rake its croupier across the property gambling table and drop lots of extra chips into the public purse.

Land tax is a hotch potch. All the states and territories have different rules. All exempt the principal residence, except NSW, which taxes mega macMansions even if they are principal residences.

All but the ACT have thresholds. In the ACT every investment property is taxed and the rate increases if the individual property’s value goes beyond a certain level. The ACT has the highest land tax in Australia.

Most other jurisdictions take the total value of all of an individual’s holding in that jurisdiction, which then determines the rate of tax. In NSW, the unimproved total value of one’s NSW property has to be more than around $800,000 before the tax kicks in. In WA, $300,000 and so on. Only the Northern Territory has no land tax. The Federal Government had imposed land tax from 1910 to 1952 when foolishly it abolished it because it was seen to be unfair to farmers.

In Queensland, until this year, if your unimproved total property value was less than $600,000, you paid no tax.

Then Queensland got infected with a combination of cunning and self-righteousness and changed the rules, in a way never done before.

Why, they asked, should someone with less than $600,000 unimproved property in Queensland pay no tax if they were a rich property-owning tycoon in other states?

So, from next month Queensland residents who own one or more investment properties will have to add the value of their interstate properties when determining land-tax liability in Queensland.

So, someone who had a modest (under $600,000 unimproved value) bolt hole in sunny Queensland who used to pay no land tax will suddenly get a big land-tax bill if they happen to own investment property in other states and territories. Ouch!

What if all the other jurisdictions followed suit? Ouch times seven.

What if the Feds chimed in? Another Ouch.

As it happens, I will have to pay land tax in Queensland for the first time. Nonetheless, I think it is a fair scheme and other states should apply it, provided they do it in the way Queensland has done.

Queensland does a notional assessment on total Australian unimproved property value, for example, $100,000 of Queensland property and $900,000 of NSW property.

That would result in a notional tax bill of about $10,000, But Queensland only levels the tax on the Queensland portion of the notional bill. In our example that is $100,000 of $1,000,000 or 10 per cent. So, our notional tax bill is reduced to 10 per cent of $10,000 or a fairly reasonable $1,000. Before the change it was zero.

In short, the capacity to pay and level of tax is determined by a person’s total Australian property holding, but only applied to the holding in the individual state, in this case Queensland.

It seems complicated, but to achieve fairness and better economic outcomes, you often need complex systems.

One of the great beauties of land tax is that land values cannot be hidden. Land tax is far superior from an economic and social-justice perspective than stamp duty.

There have been a few half-hearted attempts to replace the one-off barnacle of stamp duty with annual land taxes, but stamp duty remains appallingly high in all jurisdictions. State revenues that depend on it are subject to wild revenue fluctuations as property markets yo-yo.

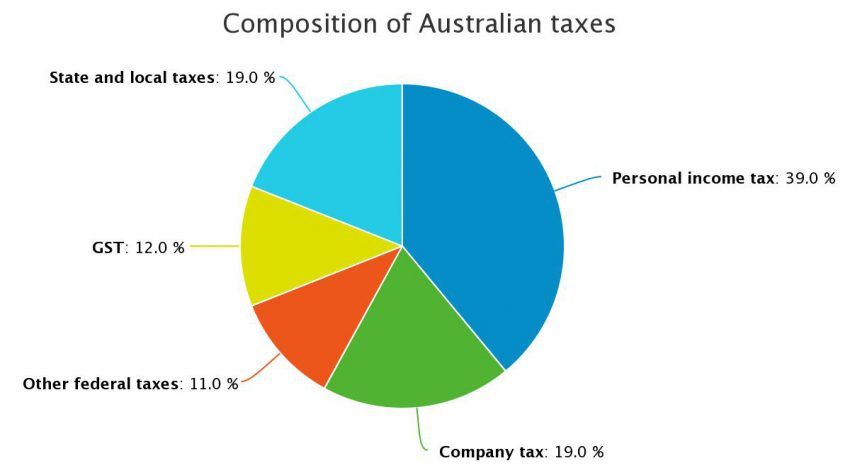

Consumption taxes like the GST are also hard to avoid. If the Government must go ahead with the madly unfair Stage 3 tax cuts, it should at least broaden the GST to capture a lot of things that mostly the wealthy spend money on: private-school fees, private health and a raft of GST-exempt semi-medicines found in pharmacies.

It should also apply the GST to all rates and land tax, with compensation for middle- and low-income families.

It should cut tax deductibility for state charges on investment property (a justifiable chink against negative gearing). It should restrict cash rebates for franked dividends to what the taxpayer got the previous year, as was done with hospital and medical spending without any song or dance.

And something has to be done about road-charging before the avalanche of electric vehicles, turns the flood of fuel taxes into a trickle.

There are lots of little tweaks that can make the tax system fairer and help with the bottom line without scaring the horses by shouting big-ticket items from the rooftops as Labor did in 2019. The Queensland land-tax changes show the way, even if it makes a few people like me say “Ouch!”

Crispin Hull

This article first appeared in The Canberra Times and other Australian media on 13 September 2022.

Agree that tax system needs overhaul. Pleased to see that Crispin is not complaining about his personal tax increase. At various times I’ve sent emails to politicians, mainly present government, that middle and higher income taxpayers should pay more tax. I’m secure in my retirement and happily would pay more tax. Especially would like to see reform of family trusts, seeing how it has encouraged greed in some of my relatives.

Subsidies, deductions and exemptions for large corporations need to be cut or eliminated, company tax increased, with appropriate exemptions for small business. Low income taxpayers should be able to claim a negative tax, as is done in the USA. Also as in US, we should have a minimum tax, applicable to individuals and companies who have large incomes and use deductions to pay little or no tax.

We do want government to provide services, we have to pay tax to enable these services to be offered.

Not sure that I agree with Crispin’s comment that a property with an unimproved capital value of $600 k is a modest bolt hole – $600k is our UICP and our very modest house about 7km from town is worth over $1m, well over the Brisbane average.

Likewise his persistent attacks on franking credit refunds it also a little curious to say the least. Franking credits are simply refunds of company tax paid, so as to avoid double taxation. In addition, the main individual beneficiaries of the refunding of franking credits are lower income workers and retirees (and superannuation funds in retirement phase, but that is a separate issue). Almost my entire personal income is from franked dividends and because my income is quite modest (under $30,000), I get most of these franking credits back. If I had a higher income I would get the benefit of the franking credits in the form of reduced tax payable (out of my pocket). Therefore to deny the refund of franking credits is to disadvantage lower income earners. The only argument that is logical is one where we totally abolish franking credits and return to the old system of double taxation of dividends (but not other forms of income such as interest and rent, which makes that option equally unfair).

His support of the new QLD land tax system is commendable. I could never understand why the system was not the case especially as the payroll tax system works in a similar way to the new QLD land tax system, ie you can’t avoid payroll tax by setting up businesses in multiple states. Maybe this is an issue the Labor Party federally should take on board to fix.

Personal income taxes are an aging, clunky system. There has been a drift over half a century away from PAYE towards contractors in most industries. The well sourced then become involved in tax planning like family trusts, self managed superannuation and even charities. It results in a split society of inequity.

Property taxes need to be streamlined nationally. Ideally CGT would apply across all property. Simplified Property Taxes have the potential to form a robust revenue stream in the same manner as income tax or GST.

However, your article is light on corporate taxation which is also a mess of inequality, deferrals and loopholes. The first cab off the rank is Resource Taxation. A national Mining Tax and reformed oil and gas tax (PRRT) should replace all State Royalties. Again, they would form a robust revenue stream.

Lastly, we need a complete review of tax concessions, grants and allowances. During any period of transitions (eg energy) we need accelerated incentives to change. Remove the archaic (eg diesel fuel rebates) for the new.

Will it happen? Oh, the heartaches and cries for pity!