IT IS difficult to work out the degree of Australia’s growing inequality in income and wealth, simply because a lot of high-wealth, high-income people disguise it. But in the past week or so a couple of publications show inequality is higher than officially recognised.

IT IS difficult to work out the degree of Australia’s growing inequality in income and wealth, simply because a lot of high-wealth, high-income people disguise it. But in the past week or so a couple of publications show inequality is higher than officially recognised.

High-wealth, high-income people hide or misreport their wealth and income to the main governmental data and revenue collection agencies: the Australian Tax Office, the Australian Bureau of Statistics, the Reserve Bank and so on.

If you use ATO figures to measure the percentage of total income received (I won’t say earned) by the top 10 per cent or top 1 per cent, you will get a distorted figure on the lower side of reality.

And at the other end, the extent of unemployment and underemployment is also under-stated. The ABS says that someone who works just one hour is not unemployed.

This week Roy Morgan published its first Wealth Report. It compares wealth in Australia now with wealth just before the Global Financial Crisis.

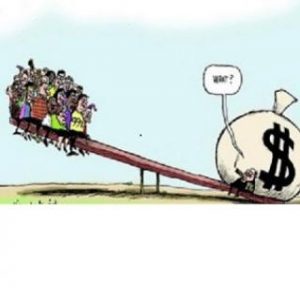

The good news is that overall wealth is increasing faster than debt. The bad news is that the rich are getting richer and the poor relatively poorer.

It confirms that, though Australia dodged the recession bullet that came with the GFC it, it did not dodge the rising inequality bullet. Essentially wage income has stagnated while income from capital has risen. That, of course, has resulted in the seething discontent among people who had hitherto seen their prospects and their children’s prospects steadily rise: the unskilled and semi-skilled mainly male manufacturing workers.

Morgan collects data in face-to-face interviews with confidence guarantees. It is likely to be more accurate than data collected by government bodies, because people might fear (rightly or wrongly) the ATO coming after them.

A week ago, shadow assistant treasurer and Member for Fenner, Andrew Leigh, delivered a speech detailing how multinationals operating in economies such as Australia can avoid tax with relative ease.

He made the significant point that a lot of these hi-tech and mining multi-nationals are not big employers. Their main contribution is to the tax base, if only they pay it. More importantly, Leigh outlined a detailed policy strategy to rein them in.

Alas, the strategy does not fit into a Tweet or a sound bite, so got little attention.

But, in a way, addressing the seismic economic shift of the past decade is almost as important as addressing climate change.

Revenue is half of what government does. In Australia we have comprehensively blundered on the revenue side over the past 35 years. On the labour/wages side the tax breaks are trivial. Not even childcare is deductible. And now excessive medical and dental costs are no longer deductible.

On the capital and corporate side, on the other hand, concessions, deductions and avoidance abound: no tax on the massive capital gains on principal residences; negative gearing; superannuation freebies; fuel rebates; accelerated depreciation; capital-gains tax concessions; and (worst of all) off-shore tax havens.

Globally, $600 billion a year of corporate profits get siphoned off to tax havens like the Cayman Islands, Bermuda and British Virgin Islands.

Multinationals whose base is a tax haven but operating in Australia siphon off up to 90 per cent of their Australian-earned operating profits to the tax haven where no tax is levied. That is a 90 per cent difference between operating profit and taxable profit. Multinationals whose base is Australia, on the other hand, have only a 30 per cent difference between operating profit and taxable profit.

Leigh announced a couple of extensions to Labor’s policy to crack down on profit shifting to tax havens, especially Australian citizens buying passports and/or citizenship of the haven countries.

Australia needs foreign investment, but the investors must pay tax on their profits or there is no point in having it.

As the tax burden on capital falls, the tax burden on labor increases. In short, the people who go to work each day (the so-called “working families” have been betrayed over the past 35 years. That is being exploited by political populists in Australia and elsewhere, harping on about nationalism and global trade. But they are not the real cause of the resentment. Rather it is the economic unfairness.

Capitalism and markets can only succeed when tempered by good regulation, effective revenue collection and a fair redistribution so everyone in society is included, but without stifling the creative forces of incentive and initiative which generate the wealth in the first place.

The effect of poor tax policies in Australia has been dramatic.

The Morgan Wealth report says that the average wealth of the top 10 per cent of wealth holders in Australia nearly doubled between 2007 (just before the GFC) to 2017: from $1.17 million to $2.01 million. Meanwhile, the bottom 50 per cent went virtually nowhere. Even the remaining 40 per cent’s wealth did not do much, increasing around 50 per cent.

Oxfam says the top 1 per cent of Australians own more than the bottom 70 percent and that inequality has been getting steadily worse in the past 10 years.

Bizarrely, this growing inequality is not good for capitalism, markets, capitalists or the very wealthy because it invites rebellion, calls for radical measures, alienation, and property crime. Further if a billionaire doubles their wealth or income it makes no difference to their life.

In summary, it seems as if the top few per cent of people who get most of their income from capital have scooped off any increase in wealth and income that workers might reasonably have expected over the past 10 years.

And people in government who assert all vessels rise the in rising economic tide wonder why they are not believed.

Unless governments do revenue-raising more fairly, expect a dangerous loss of faith in democracy and market economies.

CRISPIN HULL

This article first appeared in The Canberra Times and other Fairfax Media on 28 September 2018.