It was not so much a pork barrel, but a hydrogen barrel, that was rolled out in the knife-edge marginal Queensland seat of Flynn this week.

Opposition Leader Bill Shorten promised to set up a National Hydrogen Innovation Hub in Gladstone as part of a $1 billion plan to boost the emerging hydrogen industry.

It was good politics, combining local concerns about jobs and industry with broader concerns about global warming. It was also good science and business.

It was good politics because unlike most pork-barrelling it could not neutralised and matched by the other side, as for example the Townsville stadium in 2016 and the Cairns James Cook University hospital in 2019 and any number of roads, schools and other hospital expansions in marginal seats in the past.

Rather, the politics became better for Labor when, to the opposite of being matched, it evoked the 19thcentury response from Resources Minister Matt Canavanthat: “Coal is Australia’s biggest export, it employs thousands of people and thousands more could get jobs if Labor ended its unholy alliance with radical green activists and backed jobs.”

Well, yes, asbestos and whale oil provided thousands of jobs until their health and environmental costs became too great.

The seat of Flynn is held by the LNP by 1.04 cent, or just 814 votes. It was held by Labor from 2007 to 2010. It is one of the Reef Seats, a string of marginal seats up the Queensland coast where the fight is starkest between industry based on old coal technology which provides substantial financial aid to the Coalition on one hand and the environment, particularly the Great Barrier, on the other.

Two of the Reef Seats are the most marginal in the Parliament: Labor held the Townsville-based Herbert by just 0.02% in 2016 and the LNP holds Capricornia by just 0.63%. Three others are held by the LNP by under 4%: Flynn on 1.04%; Dawson on 3.34%; and Leichhardt on 3.95%. The other Reef Seat, Kennedy, is comfortably held by Bob Katter who heads his own party.

The fight between the reef and coal, made stark by the Coaltion-supported Adani mine, was made starker when the Turnbull Government’s attempt to look like it was doing something about the reef backfired.

In April last year, the Turnbull government announced it was giving $444 million to the Great Barrier Reef Foundation (GBRF), which at the time had annual revenue of about $10 million and only six full-time staff. The foundation was backed by business people, some in the coal industry. This month the National Audit Office found that the hastily put together grant did not meet transparency guidelines.

Meanwhile, the expert body on the reef, the 44-year-old Great Barrier Reef Marine Park Authority, went perplexed and empty-handed.

In decades past it used to be the Coalition and the conservatives who stood for progress, development, entrepreneurship and support for industry and business, especially those engaging in innovation and technology. But since 2013 the Coalition appears to have become so captive of existing industry, particularly coal and big agriculture, that it has closed its eyes to the new. It has become so blinkering that it denies the very science that would ensure sustainable business.

It used to be the Coalition that supported good business models, but since 2013 it has closed its eyes to the sound business models of renewable energy in favour of Soviet-style state intervention into heavy industry.

Many Liberal Party members are reported as being in despair and would like this mark-time, caretaker government to put an end to itself as soon as possible so the party can regroup, rethink and modernise in Opposition.

It seems unlikely that the Morrison Government has time to change its spots before the next election even if it had a mind to, which it does not.

It hands on a plate to Shorten and Labor numerous opportunities to combine the traditional pork-barrel with other electoral concerns like regional jobs, the environment and export industries.

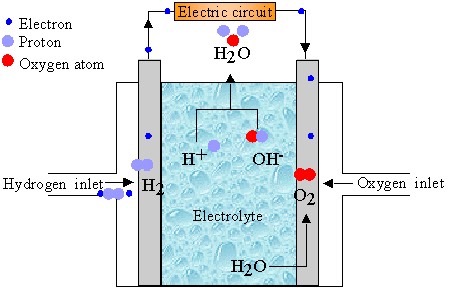

The interesting thing about clean hydrogen is that it can work like battery energy. Water can be separated into oxygen and hydrogen by the application of a solar-generated current. This is called electrolysis. The hydrogen can then be tanked and transported, including for export. On recombining with oxygen, it can generate heat and electricity.

Solar farms can be placed on Australia’s abundance of flat, sunny land which has little or no agricultural use, unlike, say, in Japan or South Korea.

Sure, the technology needs refinement, but is not decades away as the Coalition asserts. New technology tends to catch on very fast, taking a lot of people by surprise.

0 0 0 0 0 0

Speaking of business cases for renewable energy, I can report that it is five years this month since we installed our rooftop solar.

In that time it has generated 40,000kWh of electricity. At Ergon Electricity’s retail price of 25.3 cents a kWh, it comes to $10,120. The system cost us $9320.

That does not mean the system has paid for itself quite yet. Some electricity went into the grid and generated less than 25.3 cents a kWh. And some account has to be made for interest on the $9320, but a lot less than most economists would imagine because, as behavioural scientists will tell you, people are unlikely to invest the money they would spend on solar into interest-bearing deposits or repayment of existing loans. It is more likely that they would blow it on consumption.

From here on for us it will be a couple of thousand a year extra to spend on the good things in life rather than paying for electricity, much of which is coal-generated.

In all, it was a very sound investment, better than paying down a mortgage or investment loan or putting it in an interest-bearing deposit.

And certainly better than buying shares – particularly in coal-mining companies.

Shorten could have backed massive, publicly-owned renewable energy generation and battery storage infrastructure (especially graphene, aluminium-air, molten salt, or pumped hydro), but instead he’s trying to appeal to both environmentalists with so-called “green” technology, and traditional energy capitalists whose business models are dependent on artificial scarcity in the form of expendable fuels.

It’s a vile display of Labor’s fetishism of a terminally decaying paradigm and yet another reason it cannot be taken seriously as a real alternative to the current Government.

Renewable energy implementations could provide abundance to households and industry, lowering the cost of electricity (or perhaps even transforming the sector into a public utility, funded by a levy, providing a “guaranteed basic energy” allotment to all premises) – this is yet another opportunity to meaningfully improve the lives of the working classes, lost to a myopic pursuit of ideology.

Peter Blackshaw Extra facts for you.

Whitehaven had a Total Income of $2.4 billion in 2016-17, Taxable income of $5557 and paid no tax.

(ATO figures https://data.gov.au/dataset/ds-dga-c2524c87-cea4-4636-acac-599a82048a26/distribution/dist-dga-5eb443b4-d0bb-4a88-a189-4523dbcd7f15/details?q=)

Crispin paid $9320 and over 10 years has paid that off but still has the asset which delivers a saving to him of $2000 a year.

The return of having a capital (paper gain) of $16,380 with a dividend of $3000 is a much riskier investment than Solar panels. With Coal on the nose and people waking up to it’s climatic effects when burned, You could wake up and find Whitehaven worth peanuts tomorrow. Meanwhile Crispin will still have an asset which delivers a minimum return of $2000 per annum. I say Minimum because the way that Coal is going in Australia, it’s only going to get more and more expensive under a private market. Whereas Crispin will be Quarantined from such price rises.

In terms of an investment strategy (To quote the Stock market gurus. “You must take a long term view”) I believe that the less risk adverse option which delivers a lesser (short term = 10 years) but guaranteed long term return is Crispin’s strategy.

There is another tangible thing which Crispin’s strategy has done and that is reduced the burning of coal and it’s consequent emissions of Co2 Gas.

In another 10 years time Crispin will have saved himself $20,000 at least. As well as the burning of that amount of Coal which his solar panels generate. His house value has also probably appreciated by at least the value of the original asset, possibly more (but that is also subject to market fluctuation).

Another plus is that his investment is giving a tangible return yearly whereas the capital gain in the Whitehaven shares is tied up and can only be realised by selling them (at the market value of the Year,Month,Week,day? No the Hour.)

Crispin’s reasoning is what the dinosaurs of the greedy minded capitalist don’t get. He also gets enormous peace of mind by his choices, which advantage him sure, but don’t disadvantage anyone else.

Crispin probably also pays his taxes as well.

Peter Blackshaw Whitehaven pays zip for pollution. I venture there will be a class action for compensation by the next generation. That will trash your profit..fact check sqibbed

Regarding hydrogen, it’s nice you’ve put in a little explanation about electrolysis, but if you research a lot deeper, you’ll find that hydrogen is a store of energy that requires a LOT of energy to make. Compared to say using renewable energy to charge an EV directly and using it to split water, the energy efficiency is massively different. Electricity to hydrogen to EV is 3 times more efficient than via fuel cells. Three times, is not a trivial issue, and that’s got zip to do with how ‘cheap’ anyone thinks ‘renewable’ energy is.

And, standard electrolysis is a very poor energy return. To make hydrogen on truly industrial scales very efficiently, it is done at very high temperatures. This isn’t a job for low energy density weather harvesting generators. The hype about hydrogen precedes any actual commercial scale production that doesn’t also produce carbon dioxide. (It’s commercially derived from hydrocarbons because: scale)

Using other heat sources and creating large amounts of commercially viable hydrogen with zero emissions is entirely another story. And like fusion…it’s coming!

Just do not bet the planet on it.

Just out of interest, the price you paid for your PV/battery/inverter system, was any of that topped up with rebates, beyond the feed in tariffs, I mean.

Author’s reply: The feed-in tariffs are a woeful rip off. Energy companies give you 6-9 cents per kWh yet charge you 26 cents. Yes there was a government rebate of $2000. The equivalent of government subsidies for fossil fuels, I guess.

Hi Crispin,

Fact check. If you had invested $9,320 in Whitehaven, the largest independent listed miner, it would now be worth $25,700 and you would have received $3,000 in dividends.

Regards,

Peter Blackshaw

The $444m was an alarming example of the Pezzullo doctrine that the government decides what’s in the public interest, the Environment chief waving it thru in three days as ‘obvious’. But this government only seems to be attracted to projects which are against the public interest – against the interests of the electorate and the environment.