A morally bankrupt, supine, irrational sell-out was committed by the Australian Labor Party this week when it said it would acquiesce with the third, and worst, stage of the Coalition’s tax-cuts-for-the-rich policy.

The tax cuts have been legislated, but many had hoped Labor’s policy would be to reverse at least the big cuts for people on more than $185,000. Now Labor has now agreed to what amounts to the rabid flat-tax fantasies of Reagan and Thatcher.

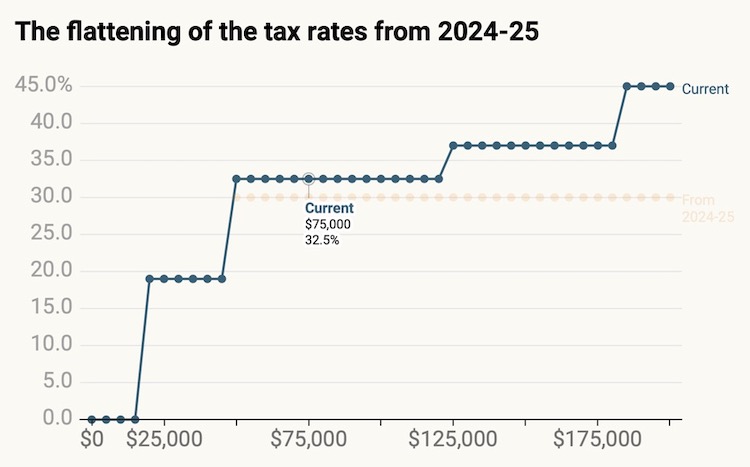

The vast majority of income earners (those earning between $45,000 and $199,999) will have a marginal tax rate of 30 per cent.

Parliamentary Budget Office figures reveal the cuts overwhelmingly favour wealthy men. It modelled the effect of the cuts to the end of the decade. By then they will have cost $184 billion.

Just 1.7 per cent of that will go to those on under $60,000. These are the people Labor should be helping. Worse, the $184 billion squandered on those who do not need it will mean less money for public health, education and other services.

The PBO calculates that the top 1 per cent of earners will be $11 billion better off over the decade. Further, the cuts are rampantly sexist. Men will get almost double the tax cuts that women get – a total of an extra $121.7 billion compared with $62.4 billion for women.

The supine bankruptcy of Labor’s decision is obvious. It would never have proposed this tax regime itself. So why concur with it, when – with the help of minor parties in the Senate – Labor could knock this regressive conservative flat-tax nirvana on its head if it won the next election.

What is the point of attaining government if in Opposition you have colluded with your opponents to emasculate the financial wherewithal to do the progressive things you want to do?

“Where will the money come from,” the conservatives will squeal when a Labor Government wants to even hold the fort on the NDIS or Medicare, let alone expand it to national dentistry.

By then we should not be asking where will the money come from. It should be a question of where did the money go. It went on this week’s capitulation to the Coalition’s low-tax-for-the-rich policy.

The decision has dashed any hope of any progressive agenda to help people in need. All that is now left for Labor is to wave some sort of progressive flag on non-financial, symbolic items like Indigenous recognition or the republic.

Good luck with that. Many people care less about symbols than government services which cost money.

The timing – in the midst of the deficit-exploding pandemic – could not have been worse. Further, the Budget is now benefiting from a boom in the price of iron ore. That will not last much longer as new resources open in South America and Africa, much of it with the help of the Chinese Government which will be eager to shut Australia out.

People used to mock the major parties in Anglosphere jurisdictions in the 1980s as Tweedledum and Tweedledee because there was not much between them.

Well, with this week’s tax decision you may as well conclude that a vote for Labor is a vote for the Coalition.

To be completely cynical, maybe the people (all Members of Parliament) in the Labor Party who came to this inexplicably inexcusable decision, thought it would benefit them personally. Because I cannot fathom any other reason for them to make it – other than the misguided fear of avoiding being wedged by the conservatives.

Labor can expect its primary vote to be further eroded by the Greens and other progressive parties.

The trouble with tax benefits is that once given (as distinct from being just legislated), they are extremely hard to take away.

The truth of that was made clear when Chris Bowen single-handedly lost the 2019 election by saying that people who did not like Labor’s policy to shrink dividend-imputation and negative-gearing rebates could vote for another party. And they did.

Once these tax cuts get paid, it will be nigh impossible to reverse them. Over the past 40 years, the top marginal rate has gradually and inexorably fallen and rates gradually flattened with resulting greater inequality and greater strain on government services.

Labor will now have to find other election-threatening sources of revenue or give up on expanding and improving services.

This month the Tax Institute proposed two significant changes. The first was to copy New Zealand and broaden the GST base to include everything and to increase it to 15 per cent while providing more than enough compensation for low and middle-income people. The second was to reduce tax compliance costs – which now run to $50 billion a year.

Labor should definitely do the second. It would mean giving everyone an automatic tax deduction for all the usual deductions of around $3000 with no receipts required. Anyone wanting higher deductions would have to be able to prove them.

With data-filling, this would wipe out the need for tax returns for more than half of income earners. Alas, it would not yield any revenue, but it would make the economy more efficient.

The GST changes would get more revenue from foreign tourists and business travellers and would raise more revenue from the well-off who spend disproportionately more on health, education and fresh food, which are now exempt.

Of course, there are other obvious reforms: an inheritance tax and tightening concessions on superannuation, capital gains, negative gearing, and share dividends.

But as the inaugural CEO of the Grattan Institute, John Daley, pointed out this week, Australian Governments are now running “a gigantic inheritance scheme” because of risk-averse politicians, vested interests, and irrational party shibboleths.

Future generations are being sold-out. Labor’s tax decision this week just adds to the woes.

Crispin Hull

This article first appeared in The Canberra Times and other Australian media on 31 July 2021.

At first I was against increasing GST bit reading on you seem to have covered richer paying more…up to a point. The proliferation of pay as you go motorways has seen the rich with their novated leases and company cars travel at the expense of the public who are forced to endure countless bus changes and overcrowded trains. I would like to see higher Fringe benefit tax or whatever tax on vehicles and company cars.

About giving everyone a tax return this was raised by Kevin Rudd when he was or was about to become PM. It was covered in the Canberra times. I think when Crispin Hull was the boss. As the American Indian tribe the heckawi used to say, politicians speak with fork Ed tongue.

Yes, this is madness, Crispin. To give those who do not need them these extra dollars to spend when we are accumulating vast debt — courtesy of Covid — is insanity.

My guess is that both Lib and Lab will resort, as soon as it is possible to do so, to pump-priming our economy with endless mass immigration to help pay the bills. Entirely unsustainable, of course, but what the heck!

How much easier — how much more equitable and sustainable — to simply raise or maintain levels of taxation on those who can afford it.

We live in a mad world where the hip-pocket nerve controls everything … and everything else be damned!

Perhaps these policies reflect this — and Labor is keen to be elected — and selling its soul is the price to be paid to be so?

It is serious, Crispin! What can we do? Don’t vote for the coalition? Ok. dont’ vote for Labour? Ok. Don’t vote for the Greens? Ok. What is left?