WE HAVE such short memories. One wet, cool summer and an Opposition scare campaign takes 20 per cent off support for action on climate change. Two years after the Montara oil spill and 17 months after the Deep Water Horizon spill in the Gulf of Mexico, the Government continues to hand out exploration and drilling licences for oil off-shore.

WE HAVE such short memories. One wet, cool summer and an Opposition scare campaign takes 20 per cent off support for action on climate change. Two years after the Montara oil spill and 17 months after the Deep Water Horizon spill in the Gulf of Mexico, the Government continues to hand out exploration and drilling licences for oil off-shore.

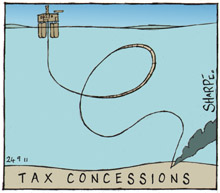

And even as the carbon tax legislation goes through Parliament this week generous tax concessions remain in place for the off-shore drillers.

In theory, as the price of oil rises, you would expect solar energy and cars powered by electricity from solar plants to be more attractive. Alas, the higher prices have only made increasingly dangerous and expensive methods of extraction more economic. This is particularly so of off-shore drilling.

The Australian Government seems to have got away – at least politically – with the Montara spill. The misdirected Australian public seems to think that a few thousand boat refugees a year pose a greater threat to our coastal security than the estimated 20 million litres of oil that gushed into the ocean from the Montara blow-out – not to mention the possibility of more spills.

The Deep Water Horizon spill was 800 million litres – the largest in history. It is now forgotten except by those whose businesses were destroyed.

Indonesia, however, has a longer memory and urged Australia again this week to come good with compensation for the damage to its fisheries and ecosystems.

The Great Australian Bight and a site 85km off the Margaret River coast are the next target for offshore exploration. Work could begin as early as next month on BP’s Bight concessions which include parts of the Great Australian Bight Marine Park. The water depth is between 1000m and 4000m.

It took 70 days to cap the Montara spill in just 80m of water. Moreover, the seas in the Great Australian Bight are some of the roughest in the world.

The prevailing wind and currents would take oil from the concessions to the South Australian coast between Ceduna and Port Lincoln. Environment aside, that might be a little more politically sensitive than a spill off the remote north-west shelf.

Even on economic grounds the whole project looks hopelessly near-sighted, especially when you consider the tax concessions.

The Howard Government introduced the special tax concessions to encourage difficult oil exploration and extraction in the face of peak oil and the likelihood of increasing dependence on foreign oil. Australia imports a third of its oil. About 90 per cent of what it produces itself is from off-shore fields.

The tax concession is massive. The oil companies get a 150 percent deduction for their costs. So if they spend $100 million in exploration and extraction for $150 million worth of oil they pay no tax. So the more costly the exploration the greater the reward – an invitation to go for more difficult areas.

The Rudd Government continued the tax concessions. A sensible government would have instead demanded environmental bonds. After all, the taxpayer inevitably picks up some if not most of the cost of any spill.

The Australian Petroleum Production and Exploration Association points out that before the Montara spill, it had been 25 years since the previous spill. That one was in Bass Strait where more than 20 rigs continue to extract oil. Nearly 3000 wells have been put down in depths ranging from 20m to 1400m – the vast majority prove fruitless.

But the Great Australian Bight concessions are deeper and rougher than we have ever gone before, and the prevailing winds and currents put population centres more at risk than before.

The environmental assets are of similar value as those in the north-west – both relatively unscathed by human interference — but the risks to them are greater because of the conditions.

The Government argues – I think correctly – that we need a tax and a market mechanism to discourage carbon emissions. Ultimately, the world will make us do it anyway as the evidence for climate change becomes obvious even to ostriches like Tony Abbott. Big-polluting countries like Australia will be hit with trade and other sanctions unless we act, so we may as well get on with it. Delay will make the pain greater later on.

So instead of giving tax concessions for ever more environmentally threatening oil drilling we should be giving more subsidies to solar. Oil will run out. It is finite. Solar is almost infinite – there are millions of years left in it yet.

DOT DOT DOT

Since 1976 just under 30,000 people have arrived into Australia by boat claiming refugee status. In those 35 years, about 3.5 million have arrived as migrants or refugees by air.

Other countries have to deal with hundreds of thousands, even millions, of refugees. We should get the matter into perspective. We certainly should not be wasting so much money (more than $600 million last year) putting people in detention in remote places when plenty of people and organisations are willing to support refugees in the community for next to nothing – even leaving humanity aside.

In any event, Australia has a responsibility to these people because we were stupid enough to join US forays into Afghanistan and Iraq which caused the refugee problem in the first place.

More importantly, we should be looking at root causes. It certainly it not merely that Australia is a nice place to live. We know this because of the dramatic changes in numbers when overseas conditions change. The boats stopped in 1980 and there were virtually none for a decade. There was a resumption in 1990, a surge in 1999, a huge drop in 2002 and a surge in 2009.

It may well be that as conditions change in Sri Lanka, Afghanistan, Pakistan, Iraq and Burma, the boats will just stop without any unnecessary, cruel measures in Australia and we will not need a Malaysian “Solution” or a Pacific “Solution” with their sub-conscious reference to the horrors of Nazi Germany.

People do not leave their homes and risk their lives on small boats in a large ocean just for better economic conditions. That is why nearly all of them turn out to be genuine refugees. An estimated four percent of them drown.

They are running away from somewhere, not running to somewhere.

CRISPIN HULL

This article first appeared in The Canberra Times on 24 September 2011.

Hi Mr Hull

There is no gain without pain. Oil drilling and shale gas exploration should continue, without the tax payer money (if the trade off is worth) and stringent conditions .

Unmarked tabako packet legislation should be repelled. I don’t smoke (I had before and stopped when it was too expensive !) and you don’t too I suppose. If we allow this law, one could argue that the packaging on bier and alcohol should be prohibited as well.

Regards

Gabriel